Flat Fee Pricing

Full Service + Fiduciary Wealth Management for a Flat Fee

Flat. Transparent. Predictable.

Our flat fee structure is based on a commitment to placing client interests first, reducing conflicts of interest, providing transparent & predictable pricing, and making financial advisory services more accessible. Financial Review (aka “Try before you buy”) clients and full-service clients will receive a comprehensive financial review & retirement field guide to achieve their retirement goals.

Flat Fee Options

-

Initial Conversation

FREE

It all begins with a conversation. We start with a complimentary Zoom call to get to know each other, understand your needs, and determine how we can work together.

___________________________________________

→ 30-minute Zoom call

-

Financial Review

$8,000

*50% Due Upfront

Best suited for those who want to “TRY BEFORE YOU BUY” with the purpose being an opportunity for both of us to determine if we enjoy working together, let you see where you are, and provide valuable insight into your top questions, concerns, and priorities. It’s ideal for those who want to understand where they are today and explore the direction they’re headed before deciding on an ongoing relationship to implement the plan.

___________________________________________

Financial Review / Retirement Guide

→ Information Gathering & Goal Setting Meeting

→ Custom Financial Review & Retirement Guide with clear action items

→ Review & Guide delivery meeting

→ 30 days of follow-up support to assist, support, and answer questions

→ Access to a secure web-portal to manage financial and retirement plan

***Clients who choose this options may upgrade at any time to our full-service ongoing wealth management relationship. If you decide you’d like to work with us in an ongoing capacity, we will credit your one-time fee toward the first year’s full-service wealth management fee.

-

Full Service Wealth Management

$12,000

*$3,000 Billed Quarterly

Best suited for pre-retirees and retirees looking for ongoing wealth management services who are willing to sign an initial 12-month agreement.

Ongoing services may be the best fit if:

✓ You prefer to delegate

✓ You want guidance on different topics as they come up

✓ You'd like to spend less time managing your finances

✓ You want continuing support from a trusted guide ✓ You are looking for ongoing planning AND management of investments (i.e. not just an hourly engagement or one-time financial plan, and not just ongoing planning WITHOUT management of investments)___________________________________________

Financial Review / Retirement Guide

→ The one-time Financial Review & Retirement Guide, plus…

→ Retirement income optimization strategies

→ Income & Tax Projections

→ Access to a secure we portal to manage accounts and plan

Investment Management

→ Ongoing discretionary investment management

→ Low-cost, tax-efficient, and globally diversified investment portfolio

→ Detailed, ongoing investment analysis

→ Access to a secure web-portal to monitor investments

Tax Planning

→ Long-term tax minimization strategies through our financial planning and investment management process

Estate Planning

→ Estate planning guidance

→ Power of Attorney Review

→ Beneficiary review

→ Charitable giving strategy

→ Wealth transfer strategy

Client Support

→ Implementation of plan and follow-up support

→ Bi-annual review

→ Unlimited support via phone, email, Zoom, and in-person meetings (for nearby clients)

***This flat fee may be higher depending upon the complexity of your case. We will quote you a final flat fee after having an intro call.

Why Flat Fee?

We are passionate about offering a flat-fee only pricing structure to deliver ethical, high-quality services that are fair, transparent, predictable, and accessible.

Working with a flat-fee financial advisor reduces conflicts of interest and allows more of your money to compound for you, not against you. We believe it’s unfair to pay more simply because you’re worth more. Our fixed-dollar fees reflect our work, not your net worth.

Because we charge a flat annual fee, our service is generally the most cost-effective for those with investable assets in excess of $1,500,000. For investable asset sizes less than $1,500,000, the traditional percent of assets under management fee used by most other advisors may be more cost effective.

We generally don't work with people whose net worth is approaching $14,000,000, as that level of wealth is more likely to lead to higher levels of financial complexity that are beyond the scope of the fee we typically charge.

Here’s Andy Panko explaining the different types of advisor fees

Unlike many advisors, our ongoing fee is not tied to the amount of your investable assets. The size of your investment accounts is a poor gauge of the complexity of your financial life and therefore a poor gauge of the amount of time and resources necessary to provide you proper planning and advice.

It's our intention that your annual fee will be the amount shown above, assuming it's appropriate for your financial circumstances. However, the more your financial profile differs from the profile of our typical client summarized above, a different level of fee may be appropriate. Your final fee will be agreed upon prior to entering a formal relationship with us.

Your annual fee is expected to increase over time with inflation, as measured by CPI-U.

On a quarterly basis, fees will be deducted directly from your investment accounts under our management at Charles Schwab or Altruist.

AUM AND COMMISION-BASED FEE STRUCTURES

How Most Firms Charge

The two most common approaches to charging clients for financial advice are the commission-based model and assets under management (AUM) approach. These two fee structures present different challenges for prospective clients.

For example, advisors that earn commissions are not fiduciary and are not legally bound to place client interests first so a client might be sold financial products they don’t need.

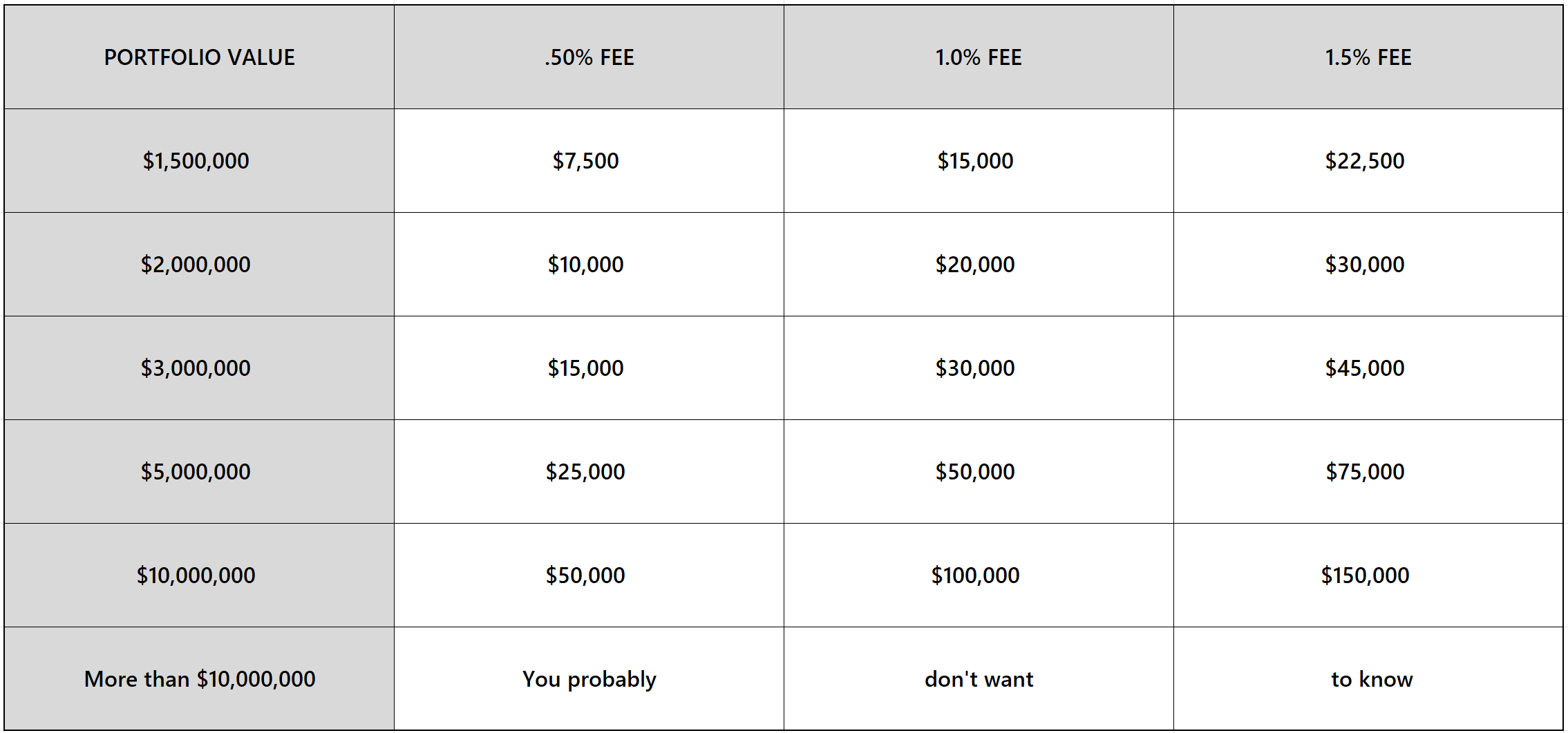

Under the AUM model, a fee is determined based on the asset balances your advisor manages, typically ranging from 0.8% – 1.5% per year. The median average is about 1%. So, if you need help managing $2 million in assets, you might expect to pay 1% in fees per year ($20,000). If a firm manages $5 million of your assets, you would likely pay $30,000 – $50,000 in annual fees. And as your assets grow, you will pay even more in annual fees.

Though the AUM model is common among wealthier clients, and widely adopted in the wealth management industry, this fee structure is no longer delivering the greatest value to clients.

The result is that many pre-retirees and retirees are sold products they don’t need and/or pay high fees for financial planning and investment management. Unfortunately, some people don’t seek out expertise guidance because of their fear of being sold unnecessary financial products or worry about high annual AUM fees. Strict account minimums often associated with AUM firms also prohibit retirees from obtaining wealth management services.

Many, if not most advisors, still charge a “percentage of assets” under management or advisement. That makes it easy for them to say, but hard for you to know how much you’re paying them in real dollars.

Do you know how much you are paying in real dollars?

Use this table to understand the fees you may be paying under “percent of assets.”